does texas have state inheritance tax

Does Texas Have an Inheritance Tax or Estate Tax. If no tax is due someone who is a Class A beneficiary can file an Affidavit for Real Property Tax Waiver.

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

State taxes on inheritances vary.

. The state repealed the inheritance tax beginning on Sept. The average local sales tax rate across the state is a bit higher than in Phoenix at 273 percent. Are also exempt from inheritance tax if they have been in existence.

Local municipalities will add their own sales tax rate to the states rate. Understanding the various considerations involved can help minimize your tax liability and maximize your May 02 2022 4 min read. You need to contact the State of Texas for this Im assuming it is Texas as this is where you posted.

Austin the state capital is quickly becoming one of the premier retirement. Texas Comptroller of Public Accounts Unclaimed Property Division Research and. If the waiver is granted an inheritance tax return doesnt have to be filed.

Check your states department of revenue treasury or taxation for details or contact a tax professional. Phone M-F 8am 5pm. Here is the contact information.

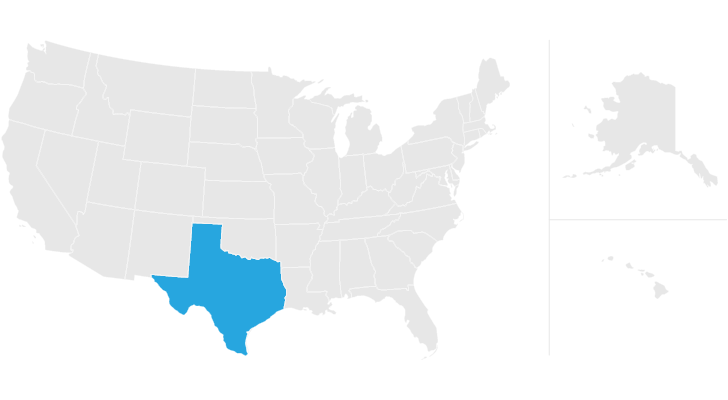

Certain property cant be transferred out of the estate until the inheritance tax is paid and the state issues a tax waiver. When added to the state sales tax rate the effective sales tax rate in Phoenix is 79 percent. Texas eliminated inheritance tax in 2005.

Final individual federal and state income tax returns. The Tax Foundation puts the states total tax burden at 98 percent making it the 24th most affordable state the least of any state with no income tax and behind other areas that do charge the. This is particularly true if you have to deal with estate taxes.

The tax burden that your estate has is another factor that could prolong the probate. With no state income tax Texas does not tax your pension or other sources of income while you enjoy your retirement years. If the estate has real estate in multiple states you may have to go through separate probate processes which may or may not delay the distribution of assets.

There are no inheritance or estate taxes in Texas. Have you inherited a 401k plan. The state will grant requests for an extension of time in which to file the return but the tax itself must still be paid by the original due date.

Because probate proceedings can be expensive and time-consuming Texas has provided a small estate affidavit procedure for decedents with small Apr 28 2022 3 min read Power of Attorney Requirements in Ohio. That said you will likely have to file some taxes on behalf of the deceased including. Consider the alternate valuation date Typically the basis of property in a decedents estate is.

For example the sales tax rate in Phoenix is 23 percent. 1-800-654-FIND 3463 or 512 463-3120 Email. If the tax is paid earlythat is within three months of the deathyou can take a discount of five percent up to a cap.

Estate tax follows federal guidelines so you may have a large estate without taxation in Texas. Each are due by the tax day of.

Texas Inheritance Laws What You Should Know Smartasset

Texas State Taxes Forbes Advisor

Texas Retirement Tax Friendliness Smartasset

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How To Avoid Probate People Thinks It S Only For The Rich If You Own Over 25k Cash Then You Mus Estate Planning Estate Planning Checklist Funeral Planning

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

How Do State And Local Individual Income Taxes Work Tax Policy Center

Texas And Tx State Individual Income Tax Return Information

Create A Living Trust In Texas Legalzoom Com

Home Buying Tax Deductions What S Tax Deductible Buying A House Tax Deductions Real Estate Estate Tax

States With Highest And Lowest Sales Tax Rates

Call Kelly At 469 631 5893 Home Buying Estate Tax Real Estate

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

State And Local Tax Deductions Data Map American History Timeline Map Diagram

Texas Estate Tax Everything You Need To Know Smartasset

Texas Sales Tax Small Business Guide Truic