knoxville tn state sales tax rate

Tennessee has state sales tax of 7 and allows local governments to collect a local option sales tax of up to 275. California has a state sales tax of 825.

Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975.

. Current Sales Tax Rate. The knoxville tennessee general sales tax rate is 7. The knoxville sales tax rate is.

The state sales tax rate is set at 700 percent. The minimum combined 2022 sales tax rate for Knoxville Tennessee is. Sales Tax Knoxville 225.

Sales Tax State 700. The base state sales tax rate in Tennessee is 7. 3 rows The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and.

A bill to help pay for a 65 million multi-use stadium in downtown Knoxville is heading to the governors desk after it was passed in the Tennessee House and Senate. The sales tax rate in Knoxville is higher than in most part of the United States. Tangible personal property taxable services amusements and digital products specifically intended for resale are not subject to tax.

Sales Tax and Use Tax Rate of Zip Code 37932 is located in Knoxville City Knox County. The Tennessee sales tax rate is currently. For example Knoxvilles sales tax is 925 775 on food while Oak Ridges rate is 975 825 on food.

The County sales tax rate is. Local tax rates in Tennessee range from 0 to 3 making the sales tax range in Tennessee 7 to 10. And since Tennessee has no income tax other than on dividends our sales tax can be deducted from our federal income tax.

31 rows Kingsport TN Sales Tax Rate. 212 per 100 assessed value. The Knoxville sales tax rate is.

Average Sales Tax With Local. The Clerk and Master will open the bidding process with the total due on the property for delinquent taxes through the 2012 tax year interest penalty fees and other cost associated with the sale owed to the City of Knoxville Tennessee and Knox County Tennessee. This is the total of state county and city sales tax rates.

For purchases in excess of 1600 an additional state tax of 275 is added up to a. The sales tax is comprised of two parts a state portion and a local portion. The Tennessee TN state sales tax rate is 70.

Addition there is a state single article tax rate of 275 which is discussed later in this text. Local Sales Tax is 225 of the first 1600. 9750 without affidavit of counseling.

Fast Easy Tax Solutions. Depending on local tax jurisdictions the total sales tax rate can be as high as 10. The tennessee state sales tax rate is 7 and the average tn.

925 7 state 225 local City Property Tax Rate. Ad Find Out Sales Tax Rates For Free. This amount is never to exceed 3600.

There are a total of 307 local tax jurisdictions across the state collecting an average local tax of 2614. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. The general state tax rate is 7.

Purchases in excess of 1600 an additional state tax of 275 is added up to a. Individual districts are allowed to add up to an additional 100. 4 rows Knoxville TN Sales Tax Rate The current total local sales tax rate in Knoxville TN is.

The local tax rate varies by county andor city. Knox Countys rate of 225 percent makes the total 9250 percent higher than the 849 percent national. 24638 per 100 assessed value.

Local collection fee is 1. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. 3750 with affidavit of counseling.

County Property Tax Rate. Retail sales to the federal government or its agencies and the State of Tennessee or a county or. State Sales Tax is 7 of purchase price less total value of trade in.

Last item for navigation. A former Knoxville business owner has been arrested after an investigation revealed he had stolen hundreds of thousands of dollars by evading taxes state revenue agents said. Knoxville TN Sales Tax Rate.

Other local-level tax rates in the state of Tennessee are quite complex compared against local-level tax rates in other states. Tennessee has 779 special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Hi im a little confussed.

Sales Tax and Use Tax Rate of Zip Code 37922 is located in Knoxville City Loudon County. Tennessee sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Find your Tennessee combined state and local tax rate.

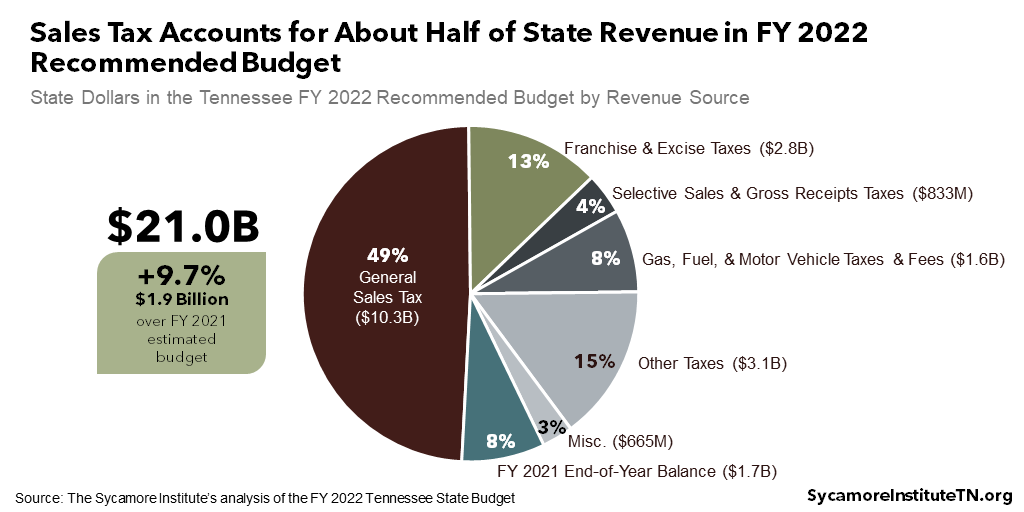

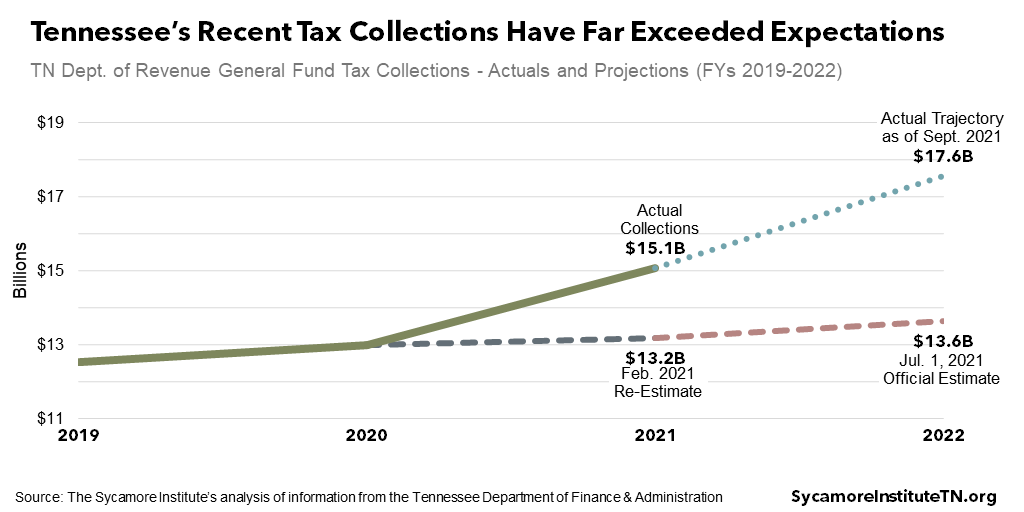

Summary Of Gov Lee S Fy 2022 Tennessee Budget Recommendation

Proof Of Funds Letter 25 Best Proof Of Funds Letter Templates Template Lab By Templatelab Com Figure Out When Letter Templates Lettering Letter Sample

The California Gridiron 1940 Football Program Football Jackie Robinson

Home Improvement Seldom At Any Point Comes Modest Yet There S A Method For Transforming That Cost Into In 2022 Refinancing Mortgage Mortgage Home Improvement Projects

Tax Consequences When Selling A House You Inherited In Knoxville Capital Gains Tax Sell My House Fast Owe Taxes

The Tennessee Counties With The Lowest Property Tax Rates

Jackson Avenue Market Knoxville Tennessee East Tennessee Smoky Mountains Cabins

Garden Conservatory Nashville Vacation California Tours Opryland Hotel

Tennessee Car Sales Tax Everything You Need To Know

Pin On Good Food In Knoxville And Chattanooga

Pin By Lauren Ashley On Across The Universe Straight Outta M Town Memphis Map Tennessee Map Memphis

How To Calculate Your Tax Bill

Airbnb Will Start Collecting Lodging Tax In Knoxville Tennessee

Tennessee May Have An Extra 3 Billion To Budget Next Year

Is 1700 Property Taxes Worth Iowa Pretty House Though Historic Homes For Sale Victorian Mansions Historic Homes

The Tennessee Counties With The Lowest Property Tax Rates

1559 Laurens Glen Ln Knoxville Tn 37923 Mls 1086055 Zillow Dream House Plans House Styles Knoxville

Mapsontheweb Infographic Map Map Sales Tax

If You Are Suffering From Dwi Charges Near Long Island And Want A Best Lawyer Who Make You Risk Free From These Charges Attorney At Law Good Lawyers Attorneys